Should XRP, the native crypto token of Ripple’s XRP ledger be regulated under the US Securities law? And Is Ripple Labs in violation of these laws? We take a closer look at the Howey test and how it applies to Ripple.

Notably, there’s an ongoing class action lawsuit against Ripple labs, filed by an XRP investor, for allegedly misleading investors by selling unregulated securities.

Read the entire article here.

This is a landmark case for the Crypto space, not just because Ripple is a leading enterprise, but also because this case could forge how consensus is reached among crypto tokens in the future.

Have you read our latest report yet? Here’s a glimpse into Monthly Report: August 2019.

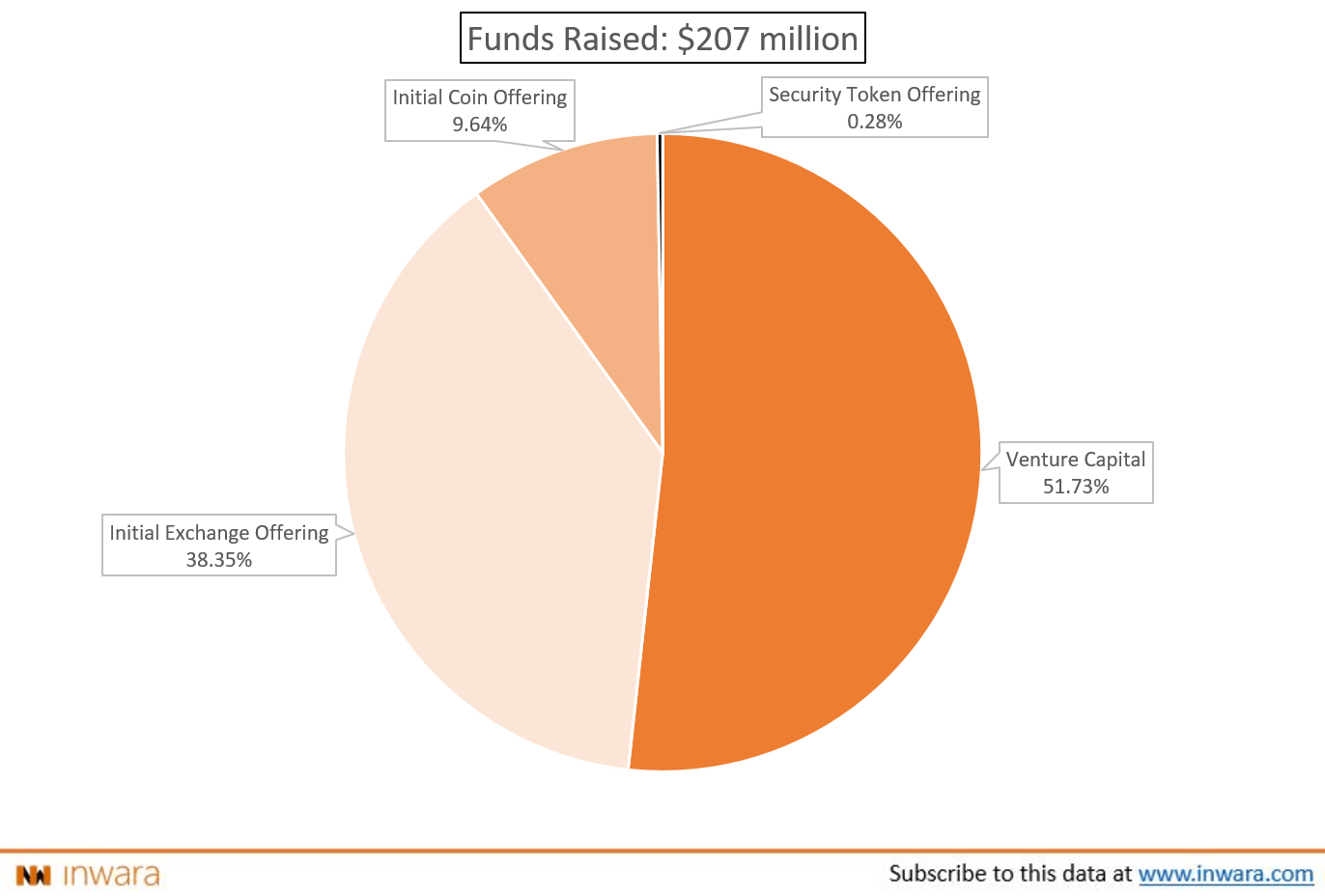

The token offerings space is going through a dry spell as Funds Raised touched yearly low of $207 million last month. IEOs continue their dominance as the go-to method for tokenized fundraising while STOs have virtually tanked.

Last week in 100 words 💯

Crypto lending gets serious as the world's largest Cryptocurrency exchange Binance, ventures into this space. Dubbed “Binance Lending”, the new product allows holders of Binance Coin (BNB), Ethereum Classic (ETC) and Tether (USDT) earn interest on their funds.

Similar Crypto lending startups like Celsius Network, has witnessed its deposits grow by as much as 2165% since it opened the business last year. The assets under management have grown to a staggering $345 million and the company has so far processed 160,000 loan transactions, according to its CEO Alex Mashinsky.

Meanwhile, Dharma, an Ethereum-based Crypto lending startups has announced it will discontinue its existing product but instead focus efforts on building a new platform connected to Compound. Notably, this shift in Dharma’s business model comes after a period of slower growth, as loan origination fell by as much as 85% from April to June 2019, according to data from Loanscan.

InWara Research 📙

Kik Interactive Vs SEC: What can startups learn?

What’s the lesson to be learnt from the SEC Vs Kik debacle? The US regulator has accused the Canadian messaging company of an alleged securities infraction by selling its Kin token to retail investors.

Is your anonymity safe against Dusting attacks?

Dusting attacks are cyber threats to your Crypto anonymity. Hackers employ this method on public Blockchain cryptocurrencies like Bitcoin and Litecoin to figure out your identity. Is there a way to prevent dusting attacks? To remain anonymous? These are our top suggestions.

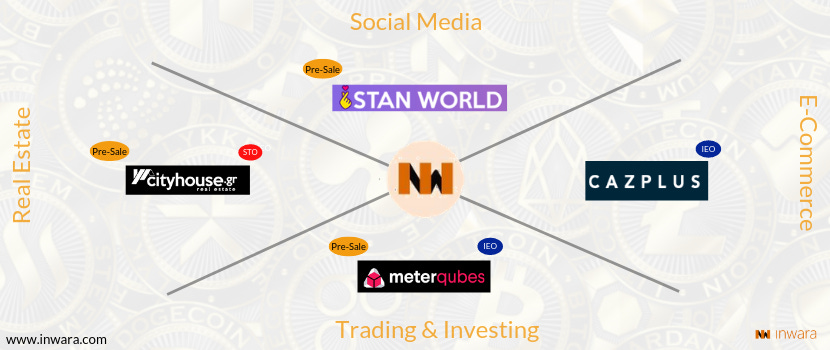

Upcoming ICOs, STOs, & IEOs 🗓️

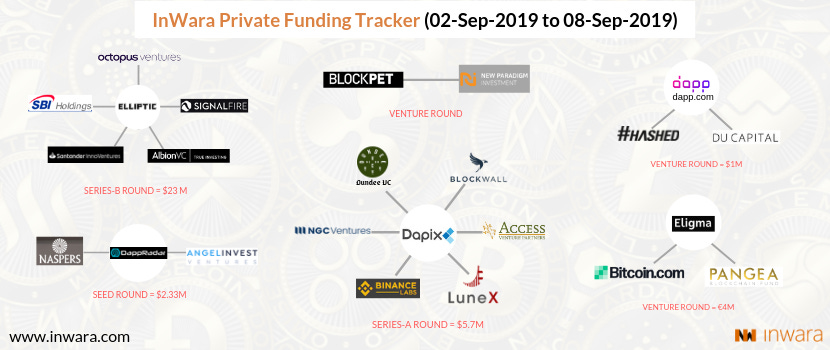

Who raised money last week? 💰

Top News 📰

NEWS: Franklin Templeton proposes a market fund with shares tokenized on stellar

Franklin Templeton Investments has filed a preliminary prospectus with the SEC for a government money market fund whose shares will be tokenized on the Stellar Network. Franklin templeton is a global investment funds with $700 billion of assets under management.

NEWS: VanEck and SolidX to offer a limited Bitcoin-ETF version to institutions

VanEck Securities and SolidX management, announced last week that they’ll allow shares in their VanEck SolidX bitcoin trust to be offered to institutions like hedge funds and banks by leveraging an SEC exemption. Notably, the shares won’t be offered to retail investors.

NEWS: Bitfinex shareholder reveals plans to mint digital yuan and commodity coins

Tether holdings, the firm that issues the stablecoin Tether (USDT), reportedly has plans to launch an offshore Chinese Yuan stablecoin dubbed CNHT, reveals Bitfinex shareholder Zhao Dong. In a recent interview Dong also revealed that Tether is also planning to launch stablecoins backed by bulk commodities like Gold, Crude Oil and even Rubber.